When a company buys a portfolio of thousands of unpaid debts across multiple countries, it doesn’t file a separate court motion for each one. That would cost millions and take years. Instead, it uses something called a Global Substitution Order - a legal shortcut that lets one entity replace another across dozens, sometimes thousands, of cases in a single filing. This isn’t science fiction. It’s happening right now in courts from London to Frankfurt, and it’s changing how global debt recovery works.

What Is a Global Substitution Order (GSO)?

A Global Substitution Order (GSO) is a court order that allows a new owner of debts or claims to step into the legal shoes of the original creditor - all at once. Think of it like transferring ownership of a car. You don’t need to re-register every trip the car ever took. You just update the title. GSOs do the same for legal claims. They were first created in 2010 by England’s High Court for Northern Rock (Asset Management) after the bank collapsed during the 2008 financial crisis. The new entity needed to take over 12,000 active debt cases. Filing each one individually would have cost over $50 million. With a GSO, it cost under $10,000. Since then, firms like Oaktree Capital and Apollo Global Management have used GSOs to replace banks like Deutsche Bank and Citibank as the named creditor in thousands of cases. The process is simple in theory: file one motion with a judge, attach a list of all affected cases, prove you legally own the debts, and promise to notify the debtors later. The court approves or denies it - usually within 22 days in the UK.How GSOs Work in Different Countries

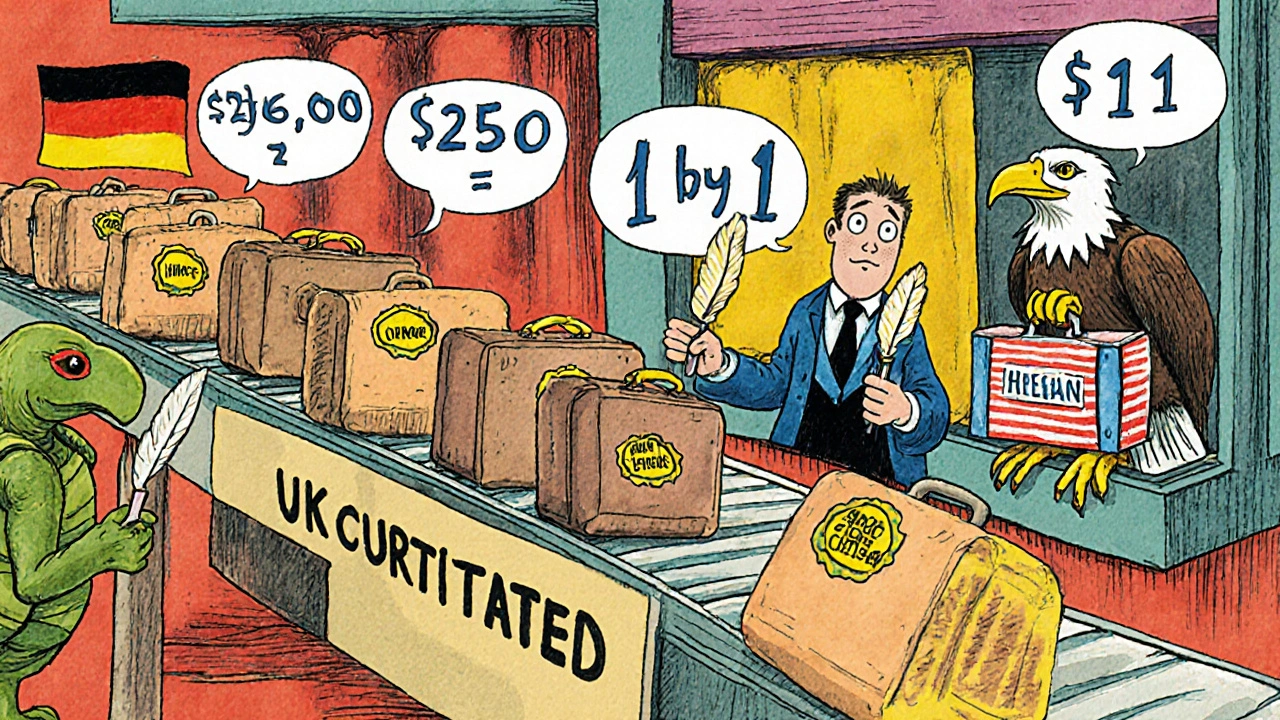

Not every country has the same system. The differences matter a lot when you’re dealing with cross-border debt.- United Kingdom: The GSO is the gold standard. Under Part 23.7 of the Civil Procedure Rules, applicants don’t need to notify defendants upfront. The court trusts the applicant to serve notice after approval. Approval rates are 92%, and costs stay flat - around £8,500 to £12,000, no matter if you’re substituting 100 claims or 2,500.

- United States: Federal Rule of Civil Procedure 25(c) allows substitution, but only case by case. There’s no bulk option. A firm buying 1,000 debts must file 1,000 motions. Each costs $500-$1,000. Total? $500,000-$1 million. That’s why most U.S. firms avoid buying international portfolios unless they can route them through UK courts first.

- European Union: Since November 2023, Directive 2023/852 forces member states to process bulk substitution requests within 30 business days. Before that, it took an average of 78 days. Now, the EU offers a unified timeline - but not a unified process. Each country still handles its own paperwork. The cost for 500 claims? Around €18,000 - more than the UK, but faster than Germany or Japan.

- Germany: Under §56 of the Zivilprozessordnung (ZPO), substitution is possible, but only one case at a time. Processing 100 claims costs €22,000-€35,000. Approval rates are lower (78%) and the process is slower (45 days average).

- Japan: No bulk substitution exists. Every single claim requires a separate application. That makes large-scale debt acquisitions nearly impossible without local partners.

Why the UK Leads - and Why It’s Controversial

The UK’s GSO system dominates because it’s fast, cheap, and predictable. According to the International Chamber of Commerce’s 2024 report, 68% of multinational debt buyers now file their first substitution motion in England and Wales - even if the debtor lives in Brazil or India. Why? Because once the GSO is granted, they can use it as leverage to push other countries to recognize the change. But there’s a dark side. In 2022, a GSO granted to Capital Receivables Europe led to 187 wrongful default judgments because defendants were never properly notified. The Court of Appeal later overturned those rulings in Patel v. Capital Receivables Europe. The problem? The UK system assumes the applicant will follow up - but doesn’t verify it. The International Bar Association found that 12% of GSO applications in 2023-2024 lacked proof of post-approval notice. That’s not a glitch. It’s a design flaw. The law gives power to the buyer, not the debtor. And when debtors are in low-income countries with poor legal access, they often never find out they’ve been sued - until their bank account is frozen.

Real Costs, Real Savings

The numbers speak for themselves. In 2025, a Reddit user from a London law firm posted about buying a $450 million debt portfolio. Without a GSO, they estimated legal fees at $285,000. With a GSO? $11,500. That’s a 96% drop. The Association of Corporate Counsel surveyed 142 legal teams in 2024. 87% said GSOs delivered “significant or substantial” cost savings. Firms that handle 15-20 GSOs a month now hire dedicated specialists - not paralegals, but lawyers who know exactly which judge requires which version of the case schedule. But here’s the catch: cost savings only work if you do it right. In 2024, 63% of GSO rejections in the UK happened because the list of cases had wrong or missing case numbers. Another 28% failed because assignment documents weren’t properly notarized. One firm lost $38,000 when a Spanish court refused to recognize their UK GSO and forced them to refile under Spanish law.What’s Changing in 2025 and Beyond

The system isn’t static. In July 2025, the UK launched the Digital Substitution Order (DSO) pilot. It uses blockchain to automatically update court records across jurisdictions when a GSO is approved. Early results show a 40% drop in processing time. The idea? Once the judge signs, the system notifies every court system involved - no manual updates needed. Meanwhile, the Hague Conference is drafting a 2025 Convention on Cross-Border Recognition of Substitution Orders. If adopted in December, it could make GSOs enforceable in over 80 countries - including the U.S., Canada, Australia, and most of Europe. The EU and U.S. also signed a Mutual Recognition Agreement in early 2025. But there’s a hitch: GDPR. If a GSO includes personal data of debtors in the EU, the buyer must prove they’re compliant with data protection rules. Many firms are now hiring privacy officers just to handle GSO paperwork. By 2027, Deloitte predicts 75% of major debt acquisitions will use automated systems to file GSOs. But the March 2025 breach of a UK litigation finance firm - which exposed 12,843 debtor records - has raised alarms. Cybersecurity isn’t just an IT issue anymore. It’s a legal one.

Who Uses GSOs - and Who Gets Hurt

GSOs benefit big players: private equity firms, hedge funds, and institutional debt buyers. They’re designed for volume. The top 10 debt buyers now control 67% of the global market - up from 42% in 2020. But the small debtor? They’re often invisible. A pensioner in Portugal who missed a payment five years ago doesn’t know their debt was sold to a firm in Delaware, then transferred to a UK court, then substituted under a GSO. They get a letter in the mail - if they get one at all. And by then, it’s too late. Some legal experts call GSOs the most efficient innovation since e-filing. Others call them a loophole that bypasses due process. The truth? They’re both.What You Need to Know If You’re Involved

If you’re a company buying debt internationally:- Always file the GSO in England and Wales first - it’s the cheapest and fastest path.

- Double-check every case number. One typo = rejection.

- Keep proof of assignment. A simple contract isn’t enough. You need signed, notarized transfer documents.

- Plan for notice. Use tracked delivery, email confirmation, and public notices. Don’t assume the court will check.

- Expect resistance in non-UK jurisdictions. Spain, Italy, and Brazil still require local filings.

- Check your local court records. You may have been added to a GSO without knowing.

- Request a copy of the substitution order. You have the right to see it.

- Consult a lawyer immediately. If you were never notified, you may be able to overturn a default judgment.

The Future Is Automated - But Not Fair

Global substitution laws are evolving fast. The trend is clear: efficiency over fairness. Systems are being built to move money, not protect people. The technology is brilliant. The ethics? Still being debated. The next big question isn’t whether GSOs will spread - they already have. It’s whether the world will add safeguards before the system becomes too powerful to control.What is a Global Substitution Order (GSO)?

A Global Substitution Order (GSO) is a single court order that allows a new owner of debts or claims to replace the original creditor across multiple legal cases at once. It’s used primarily by firms that buy large portfolios of debt - sometimes thousands of cases - and need to legally take over enforcement rights without filing separate motions for each one. First created in England in 2010, GSOs cut legal costs by up to 85% compared to individual filings.

Which countries accept GSOs? Can I use one in the U.S.?

The UK is the only country with a formal, widely used GSO system. The U.S. does not allow bulk substitution. Under Federal Rule of Civil Procedure 25(c), each case must have its own substitution motion. However, many U.S. firms file their first substitution in the UK - even if the debtor is in Texas - because a UK GSO gives them legal leverage to push other courts to recognize the change. The EU has harmonized timelines since 2023, but each member state still handles its own paperwork.

How much does a GSO cost?

In the UK, a GSO application costs between £8,500 and £12,000, regardless of whether you’re substituting 100 claims or 2,500. In Germany, processing 100 claims individually costs €22,000-€35,000. In the EU, a cross-border substitution for up to 500 claims runs about €18,000. In the U.S., filing 1,000 individual motions can cost $500,000-$1 million. The UK system is by far the most cost-efficient.

Why are GSOs controversial?

GSOs are controversial because they allow substitution without notifying defendants upfront. In the 2022 case Patel v. Capital Receivables Europe, 317 debtors were never informed of the substitution, leading to 187 wrongful default judgments. Critics argue the system favors large financial firms over individual debtors, especially in countries with weak legal protections. While the UK court requires notice after approval, it doesn’t verify whether it happened - creating a gap in due process.

What’s the Digital Substitution Order (DSO)?

The Digital Substitution Order (DSO) is a UK pilot program launched in July 2025 that uses blockchain to automatically update court records across jurisdictions after a GSO is approved. Instead of manually sending documents to each court, the system pushes updates digitally. Early results show a 40% reduction in processing time. It’s designed to reduce errors and speed up cross-border enforcement - but cybersecurity risks remain a concern after a March 2025 data breach exposed over 12,000 debtor records.

Can I challenge a GSO if I’m a debtor?

Yes. If you were never properly notified of the substitution, you can apply to set aside a default judgment. You’ll need to prove you had no knowledge of the court action and that the substitution violated procedural rules. Courts in the UK, EU, and some U.S. states have overturned judgments when notice was missing. Always request a copy of the substitution order from the court and consult a local attorney immediately.

Bro this is wild 😳 I just found out my uncle’s debt got sold to some London firm and they just swapped names in court without telling him. Now his bank account’s frozen and he’s like ‘wtf’ 😅

Honestly this is one of those things that feels like magic if you’re on the buying side and terrifying if you’re the debtor. The UK system is a masterpiece of efficiency - £10k to handle 2500 cases? That’s like turning a law firm into a vending machine. But yeah, the lack of enforced notice? That’s not efficiency, that’s negligence wrapped in a suit. We need oversight, not just speed.

This is exactly why America shouldn’t copy the UK. You let private equity firms bypass due process like it’s a free pass? This isn’t innovation - it’s legal theft. And don’t even get me started on blockchain ‘solutions’ - you think hackers don’t love a system that automates debtor exposure? This is how dystopias get built by accountants.

So let me get this straight a company buys a bunch of debt then goes to court and says hey I own all these now and the judge just says okay cool? No one even gets a letter first? That’s insane. My cousin got sued for a 500 dollar medical bill from 2018 and he didn’t even know until his car got repossessed

Of course the UK leads this nonsense - they’ve been outsourcing justice to hedge funds since the Thatcher era. This isn’t legal reform it’s financial colonization. The EU’s 30-day rule? Cute. Meanwhile, the US is stuck filing 1000 motions because they still believe in things like ‘due process’ and ‘the Constitution’ - which is why they’re losing the global debt game. The real winners? The lawyers who write the forms.

Let me be clear: if you’re using a GSO to collect from people in Nigeria, Brazil, or India - you’re preying on the powerless. These aren’t ‘debts’ - they’re predatory loans sold to people who couldn’t read the contract. And now you’ve got a legal machine that lets you freeze their bank accounts without even saying hello? This isn’t capitalism - it’s feudalism with a spreadsheet.

As someone who has worked in international compliance for over a decade, I must emphasize that the GDPR implications of GSOs are not merely technical - they are existential. The transfer of personal data under a substitution order without explicit consent or lawful basis violates Article 6 and Article 9 of the GDPR. Firms that treat this as a paperwork issue are setting themselves up for multi-million-euro fines. This is not a jurisdictional loophole - it is a legal time bomb.

It’s fascinating how the UK’s legal system has become the de facto global debt arbitration hub - a kind of financial Swiss canton. But let’s not pretend this is neutral. The fact that firms route everything through London, even when the debtor is in Jakarta, reveals a colonial mindset: the West writes the rules, the rest of the world pays the price. The DSO? Just a blockchain veneer on an exploitative architecture. The real innovation is in the profit margins - not the procedure.

I’m curious - if a debtor in, say, Mexico, receives a notice from a UK court about a substitution order, how do they even begin to challenge it? Do they need a British lawyer? Is there a free legal aid option? Or are they expected to navigate a foreign legal system with no translation, no context, and no support? The efficiency of GSOs is undeniable, but the human cost is being treated like a footnote in a spreadsheet. We’re optimizing for cost, not justice.

If you’re filing a GSO, please - PLEASE - triple-check your case numbers. I’ve seen firms lose $38,000 because someone typed ‘12345’ instead of ‘123456’. And don’t forget the notarization. A simple signed contract? Useless. You need wet ink, a notary seal, and a chain of custody. One mistake, and your whole portfolio gets stuck in legal purgatory. Also - send notice via certified mail, email, AND public notice. Don’t assume the court will check. They won’t. I’ve seen it too many times.

The emergence of the Digital Substitution Order (DSO) represents a paradigmatic shift in the architecture of cross-border legal enforcement - one that, while technologically elegant and operationally transformative, simultaneously introduces novel vectors of systemic vulnerability. The integration of blockchain technology into judicial record-keeping, while ostensibly enhancing transparency and reducing administrative latency, concurrently centralizes critical legal data within a single, immutable, and cyber-exposed infrastructure. The March 2025 breach, which exposed 12,843 debtor records, is not an anomaly - it is an inevitability born of conflating operational efficiency with procedural integrity. The legal community must now confront the uncomfortable truth: that the speed of innovation has outpaced the ethical frameworks necessary to safeguard individual rights within a globalized, digitized legal ecosystem. Until we codify data minimization, consent protocols, and automated redress mechanisms into the DSO protocol itself, we are not modernizing justice - we are automating injustice.