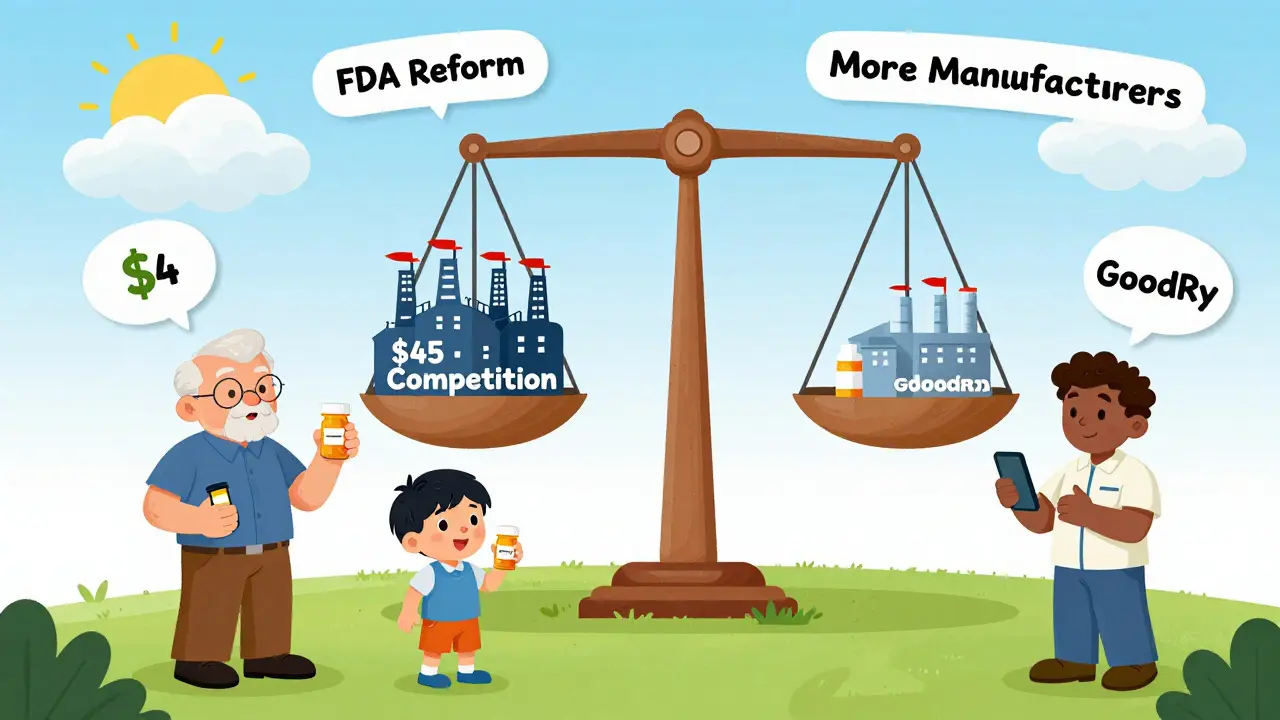

When you fill a prescription for a generic drug, you expect to pay less than the brand-name version. That’s usually true - but not always. Over the last decade, generic drug prices have followed a wild rollercoaster. Some dropped by 90% after competition kicked in. Others spiked over 1,000% in just a few years. If you’ve seen your $4 pill jump to $45, you’re not imagining it. Here’s what’s really happening with generic drug prices year by year.

How Generic Drugs Are Supposed to Work

Generic drugs are exact copies of brand-name medicines. Same active ingredient. Same dose. Same way your body uses it. The only difference? No patent. That means other companies can make it, too. When that happens, prices should crash. And they often do.The FDA says when a second company starts making a generic, prices drop about 30-40%. With three or more competitors, they fall another 20-30%. By the time five companies are making it, prices can be just 15% of what the brand charged. That’s why generics make up 90% of all prescriptions but only 23% of total drug spending in the U.S.

Take levothyroxine, the thyroid medication. Between 2013 and 2018, its price dropped 87%. That’s because dozens of manufacturers entered the market. But then there’s nitrofurantoin macrocrystals - a simple antibiotic. Its price went up 1,272% over the same period. Why? Only three companies made it. When one shut down production, the others raised prices fast.

Year-by-Year Price Trends

Looking at the big picture, generic drug prices have trended downward overall. But that average hides extreme swings. In 2023, the overall list price of generics rose just 4.9%. Sounds low, right? But that number is misleading.

Between January 2022 and January 2023, about 40 generic drugs saw price hikes averaging 39%. Some went up over 100%. Meanwhile, 60% of generics stayed stable - changes under 5%. Another 25% shifted a little, between 5% and 20%. But 15%? They moved more than 20%. That small group drives most of the cost chaos.

Medicaid data from 2013-2014 showed 8.2% of generic prescriptions jumped 100% to 500% in a single year. That’s not rare. It’s common in markets with few manufacturers. In fact, 78% of all generic price spikes over 100% happened in markets with three or fewer companies making the drug.

Why Some Generics Skyrocket

It’s not about manufacturing costs. It’s about competition. When only one or two companies make a drug, they have control. No pressure to lower prices. If one shuts down - due to a factory issue, regulatory problem, or just quitting the market - the others raise prices fast.

Between 2013 and 2018, the number of generic manufacturers dropped from 150 to 80. The top 10 now control 70% of the market. That’s consolidation. And it’s dangerous. The FDA says markets with three or fewer manufacturers become “fragile.” When one leaves, prices can jump over 1,000%.

Take the case of generic lisinopril. In 2022, a Walmart customer paid $4 for a 30-day supply. By late 2023, it was $45. That’s a 247% increase. Why? Only three companies made it. One stopped production. The other two raised prices - and pharmacies had no choice but to pass it on.

Supply Chain Problems Make It Worse

Most generic drugs are made overseas. The FDA found that 23% of foreign manufacturing facilities had quality issues in 2023. When one plant fails inspection, production stops. If that plant made 60% of a drug’s supply? The price spikes. And it can take months to fix.

Over 35% of generic drug shortages in 2022 were tied to price increases over 50%. The average shortage lasted over six months. During that time, pharmacies scrambled to find alternatives - often at higher cost. Independent pharmacies absorbed $3.75 per prescription in margin loss on average. Some went from profitable to losing money on the same drug in weeks.

Then there’s the Medicaid Best Price rule. Manufacturers must offer the same lowest price to every buyer - Medicare, Medicaid, private insurers. That makes it hard to compete on price. If one company lowers its price, they all have to. But if one leaves? The rest can raise prices without penalty.

Who Gets Hit the Hardest

Patients. Especially seniors on Medicare Part D. In January 2024, 37% of seniors taking generics reported skipping doses or cutting pills in half because of cost. That’s up from 29% in 2020. For some, it’s not about choosing between medicine and groceries - it’s choosing between medicine and rent.

Even though generics are cheaper on average, they account for 8% of Medicare spending. Why? Because millions of people take them. A small price hike on a widely used drug like apixaban (the generic version of Eliquis) adds up fast. A $10 increase per prescription for 5 million users? That’s $60 million more in costs in one year.

GoodRx users save an average of $112.50 per generic prescription compared to cash prices at big pharmacies. But not everyone uses GoodRx. Many pay full price - and get hit by sudden spikes.

What’s Changing Now

The Inflation Reduction Act didn’t directly control generic prices. But it changed how brand-name drugs are priced. That’s indirectly helping generics. With brand drugs facing rebates, more insurers are pushing generics. That should increase competition.

The FDA’s 2024 plan targets drugs with few manufacturers. They’re speeding up approvals for those - aiming for 20% faster reviews. The FTC has 12 active investigations into unjustified price hikes in low-competition markets. And Medicaid’s new rule, which removed the cap on rebates, has already triggered price drops on over 20 brand drugs.

Still, experts warn: the system is still broken. The Congressional Budget Office predicts generic prices will grow at just 1.5% annually through 2030 - slower than brand drugs. But that doesn’t mean stability. It means volatility will keep happening - just in fewer places.

What This Means for You

If you take generics:

- Check prices monthly. Use GoodRx or SingleCare. Prices change fast.

- If your price jumps 50% or more, ask your pharmacist: “Is there another manufacturer?” Sometimes switching brands saves you half the cost.

- Ask your doctor about alternatives. Not all generics are equal. Sometimes a different drug in the same class works just as well.

- Don’t skip doses. Talk to your doctor or pharmacist if you can’t afford it. Many drugmakers have patient assistance programs.

For the system to work, we need more manufacturers - not fewer. More competition means lower prices. Right now, the market is too concentrated. And that’s where the risk lies.

Why do generic drug prices go up even when they’re supposed to be cheaper?

Generic prices usually fall after entry, but they can spike when competition drops. If only one or two companies make a drug and one leaves the market, the others raise prices quickly. This happens most often with older, low-cost drugs where profit margins are thin and manufacturers exit when it’s not worth the effort.

Are generic drugs always cheaper than brand-name drugs?

Generally, yes - but not always. On average, generics cost 80-85% less. But in markets with little competition, some generics cost nearly as much as the brand. For example, in 2023, a few generics were priced at 70-80% of their brand-name equivalent because no other manufacturers were making them.

What’s the difference between list price and what I pay at the pharmacy?

List price is what the manufacturer charges the wholesaler. What you pay is the final retail price - which includes pharmacy markup, insurance discounts, and rebates. Insurance plans often negotiate lower prices, but cash-paying patients pay the full list price. That’s why GoodRx can show prices 50% lower than the pharmacy’s sticker price.

Can I switch to a different generic version of the same drug?

Yes, if your doctor approves. Different manufacturers make the same generic, and their prices vary. One version might cost $5 while another costs $45. Pharmacists can often substitute - but you need to ask. Always check the label to see who made it.

Why are generic drug prices higher in the U.S. than in Europe?

In Europe, governments negotiate prices directly with manufacturers and set strict limits. In the U.S., there’s no central negotiation. Prices are set by market competition - which often fails when manufacturers consolidate. As a result, U.S. generic prices average 80% higher than European prices, even though manufacturing costs are similar.

What’s Next?

Generic drugs are one of the most effective tools for lowering healthcare costs. But their pricing system is fragile. The solution isn’t more regulation - it’s more competition. More manufacturers. Fewer monopolies. And better oversight of supply chains.

For now, patients need to stay alert. Prices won’t always be predictable. But with the right tools - and a little persistence - you can still find affordable options. The system isn’t broken for everyone. But for those caught in the gaps, it’s costing lives.